Once your account is fully verified, you will be able to enjoy the benefits of the QCS Holding platform and our products in full. To verify your account, you are required to provide us with proof of identity (POI) and proof of residence (POR) and complete a quick questionnaire (Appropriateness test and Economic profile). You can upload the documents through the QCS Holding dashboard or use the QCS Holding Mobile App to directly scan your documents and upload them on our system. It is a very simple and straightforward process.

Proof of identity

We accept all government-issued identification documents such as Passport, national ID card, driving license or other government-issued ID. The document must be valid and must contain your full name, date of birth, a clear photograph, issue date, and if it has to have an expiry date, that should be visible as well. A passport is the preferred proof of identity, as it is the document which will be the quickest for the BDswiss Back Office team to process. If the document has two sides, then scans of the front and back side must be uploaded.

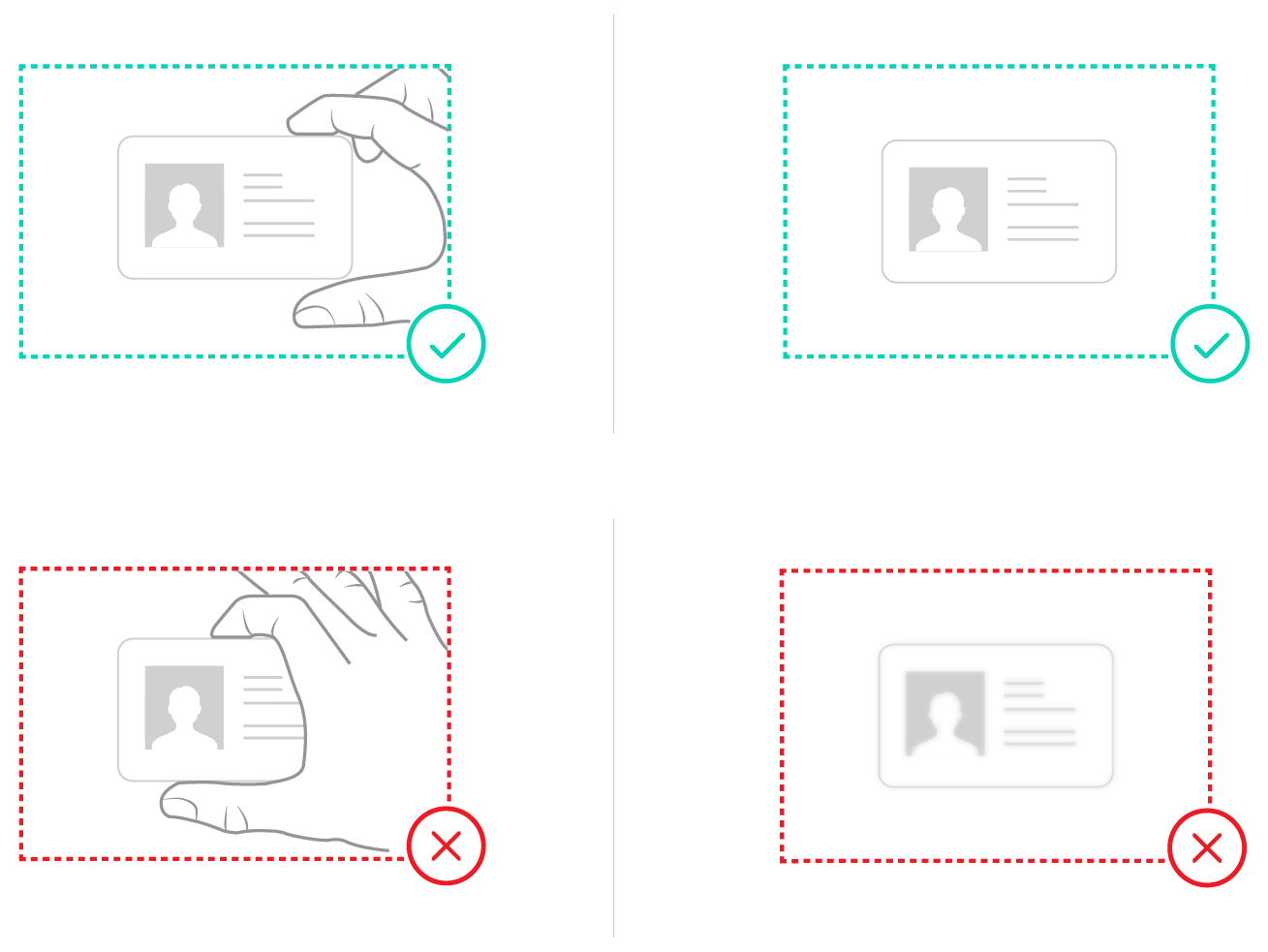

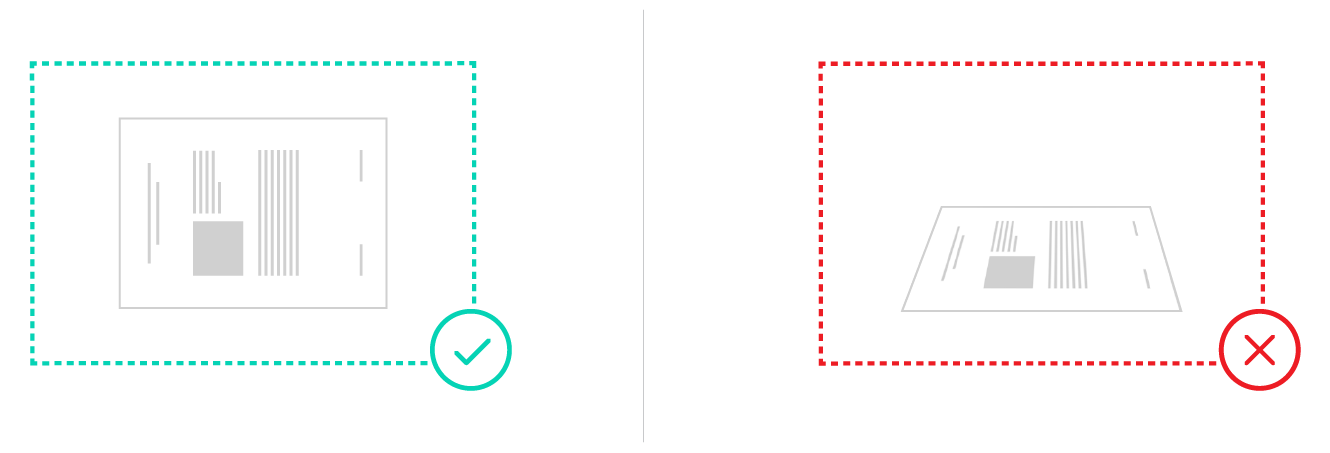

- All of the information on your identification document must be clearly visible.

- Ensure to upload the full picture, without cropping and in focus

Proof of residence

Proof of residence/address document must be issued in the name of the QCS Holding account holder within the last 3 months and must contain your name, current residential address, issue date and issuing authority. We accept any bills that are issued by a financial institution, a utility company, a government agency or a judicial authority. If your bill or document is available online, you may send it to us either as a PDF file or as a screenshot. Acceptable documents are the following:

- Electricity, water, gas, internet or telephone bill

- Bank statement

- Credit card statement

- Bank reference letter

- Tax letter

- Council tax bill (for the current year)

- Social insurance statement

- Government-issued Certificate of Residence

- Notarized Affidavit of Residence

- House Rental Official Agreement – Issued from a Rental Agent (not older than 1 year)

Questionnaires

As a regulated company, we are obliged by law to collect certain information about clients during the application process:

- The Appropriateness Assessment Test is part of this process which helps us ensure that the customer has an understanding of the risks involved and has the relevant experience required in the financial markets. The Assessment ensures that you are given access to the leveraged products and services you are most suited for.

- The Assessment of client’s economic situation is the second part of this process which allows us to ensure that the customer’s financial situation is in line with his funding patterns and also adds an extra level of verification for AML purposes.

Account opening or Registration

We accept registrations in the client’s real/official name as stated in the identification documents only. Therefore, please ensure that you provide us with accurate and valid information from the beginning. In case you register using a fake name or a nickname, your account will be rejected.

After you have opened an account with QCS Holding, you are asked to complete personal details (date of birth, residential address details, etc.) as soon as possible. This should help you speed up the verification process.

Deposit verification

You may be required to provide additional information and/or documentation after your first deposit and/or after some period of time during which you have funded your account (whether you have used one or multiple payment options; or one or multiple cards/accounts).

What are the possible reasons for requesting additional documents/information?

- You have funded your account using credit/debit card or virtual card;

- The origin of your funds cannot be verified from the deposit and proof of payment required (i.e. evidence confirming the funds have been sent from a card/bank account in QCS Holding account holder name);

- You have reached a certain deposit limit where additional verification is required, as per AML and our company’s internal policies.

Documents renewal process

On the occasion when one or both of your verification documents (POI/POR) have expired, we will contact you to provide us with a copy of the updated document.